Key themes shaping the next frontier in A2A payments

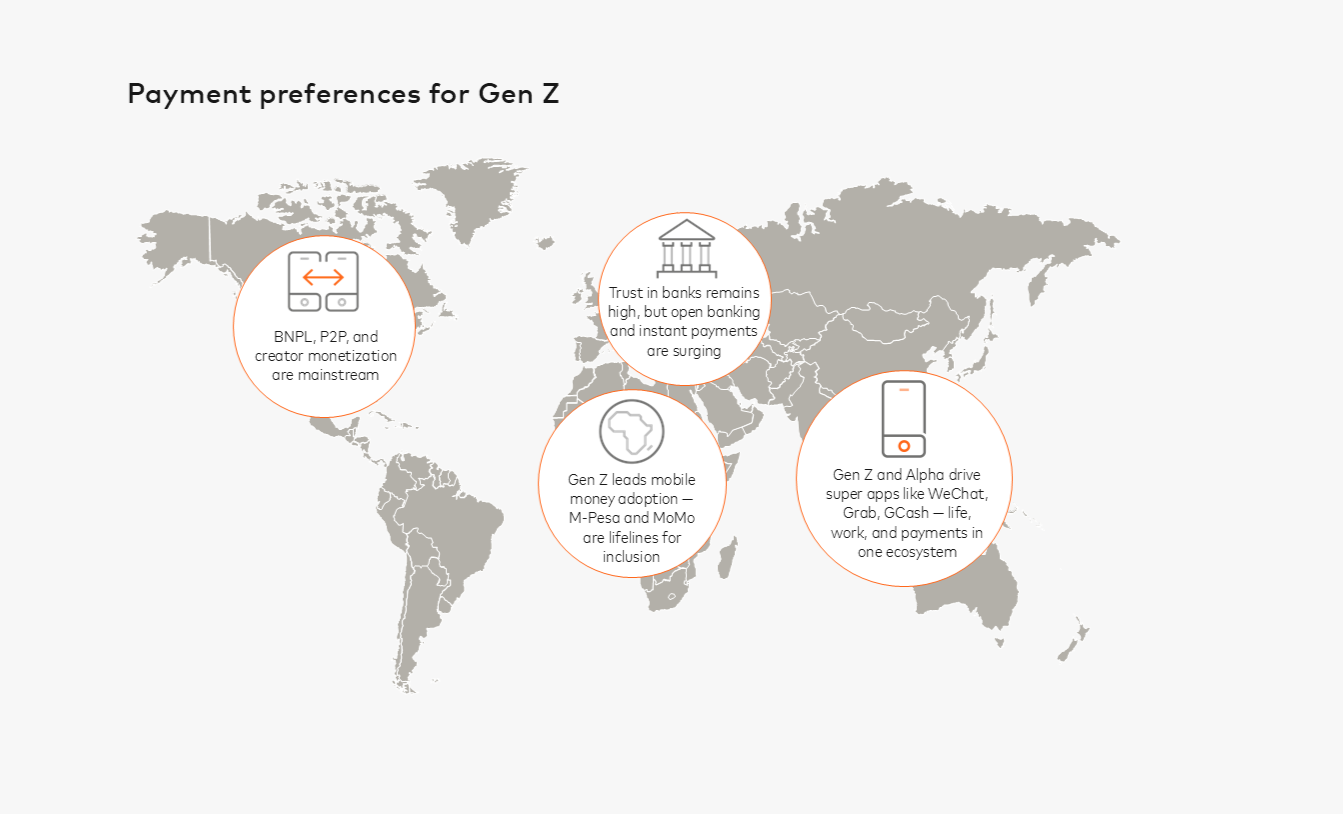

Money and commerce are in the midst of a makeover. The demands of younger generations - who are digital and AI natives - are redefining how we send and receive money and shaping the next frontier of payments.

With Gen Z demanding trust and transparency, and Gen Alpha expecting intelligent, immersive, and seamless payment journeys, it is not enough for payment providers to simply adapt. It’s about fundamentally reshaping infrastructures to meet these generations where they are and deliver instant, borderless, invisible, and value-driven experiences.

Understanding the perspectives and expectations of these emerging generations is key to building payment solutions that remain relevant and resilient in a rapidly evolving landscape. For global account-to-account (A2A) payments specifically, there are three key areas that will be at the forefront of future innovation:

-

-

Cross-system and cross-border interoperability

-

Convergence with digital assets

-

Resilience, protection, and security

-

These themes are already prominent across the global payments ecosystem, but staying ahead of them is integral to building a payments landscape that is equipped for the modern-day demands of users.

Cross-system and cross-border interoperability

Interoperability – both between different payment options in a single market, and between different markets – is fundamental to the future of A2A.

For consumers – particularly younger generations who have high digital trust and intuition – this means seamless interaction with the tools they use daily, allowing them to pay and get paid in ways that suit them. For businesses, it means lower costs and streamlined settlements, making international growth more accessible.

Building interoperability between real-time systems is particularly pressing given Gen Alpha and Gen Z’s mobile-first preferences driving expectations for instant payments across multiple payment methods.

Equally, the ability to make A2A cross-border payments in real time is key to achieving the Financial Stability Board’s G20 goals.

For Pratik Khowala, Global Head of Transfer Solutions, Mastercard, collaboration between policymakers and the private sector when building payment systems is at the heart of success:

Convergence of A2A payments with digital assets

We’re seeing digital assets become more central to the payment ecosystem, but people need a way to use them that complements A2A systems. This could be, for example, through digital wallets that are able to hold both bank balances and digital assets, or remittance apps that can send funds using stablecoins and be received in a local bank account in fiat currency.

The pace of adoption for wider use cases, including peer-to-peer payments, will be driven by digital natives and Gen Alpha who have grown up with digital currencies embedded in their everyday lives. For many of this generation, who have grown up socializing in virtual gaming environments, their first money was the Roblox currency, Robux, or V-Bucks, setting expectations for embedded, immersive and seamless payments from an early age.

Resiliency, protection and security

While innovation may be considered by many to be a more exciting, fast-moving area of payments technology, the importance of a resilient real-time system that protects users and scales securely cannot be overstated. This includes the resiliency to handle high transaction volumes during peak moments, such as pay days, and the ability to continue operating during national emergencies or system-wide incidents.

Protection and security are also non-negotiable in the current environment. This is true for all generations. While Gen Z and Gen Alpha want convenience and new technologies – such as in checkout processes and biometrics – security is equally important as innovation to them, with 40% abandoning deals due to ‘fear of messing up’, which is a greater concern than ‘fear of missing out’.

As demand for real-time payments grows, customers are also looking for systems that can support a wider range of use cases.

Staying ahead to deliver payments fit for the future

Choice and trust must always be at the forefront of payments, and people of all generations must be empowered to pay and get paid in a way that works for them.

But as the expectations of digital and AI natives become more apparent, the payments landscape will inevitably shift, and we will see the emergence of the next frontier of A2A payments. This frontier will be defined by seamless connectivity, trusted innovation, and resilient infrastructure.

Leaders from across the payments space – including central banks, regulators, payment system operators and financial institutions – must come together to build interoperable, always-on systems, integrate digital assets responsibly, and ensure every transaction is secure.