INTRODUCING A2A TRANSACTION FRAUD MONITORING

Protecting your customers and your brand

A2A Transaction Fraud Monitoring protects issuers and their customers from person-to-person (P2P), digital wallet and QR code payment fraud, providing risk scores in near-real time.

THE A2A TRANSACTION FRAUD MONITORING ADVANTAGE

With Mastercard AI, you will detect fraudulent transactions resulting from scams such as social engineering, authorized push payments and account takeover (ATO).

HOW DOES A2A TRANSACTION FRAUD MONITORING WORK?

Step one

Custom A2A models are built quickly using your historical data.

Step two

Once deployed, the model scores transactions and indicates the likelihood of scams or fraud.

Step three

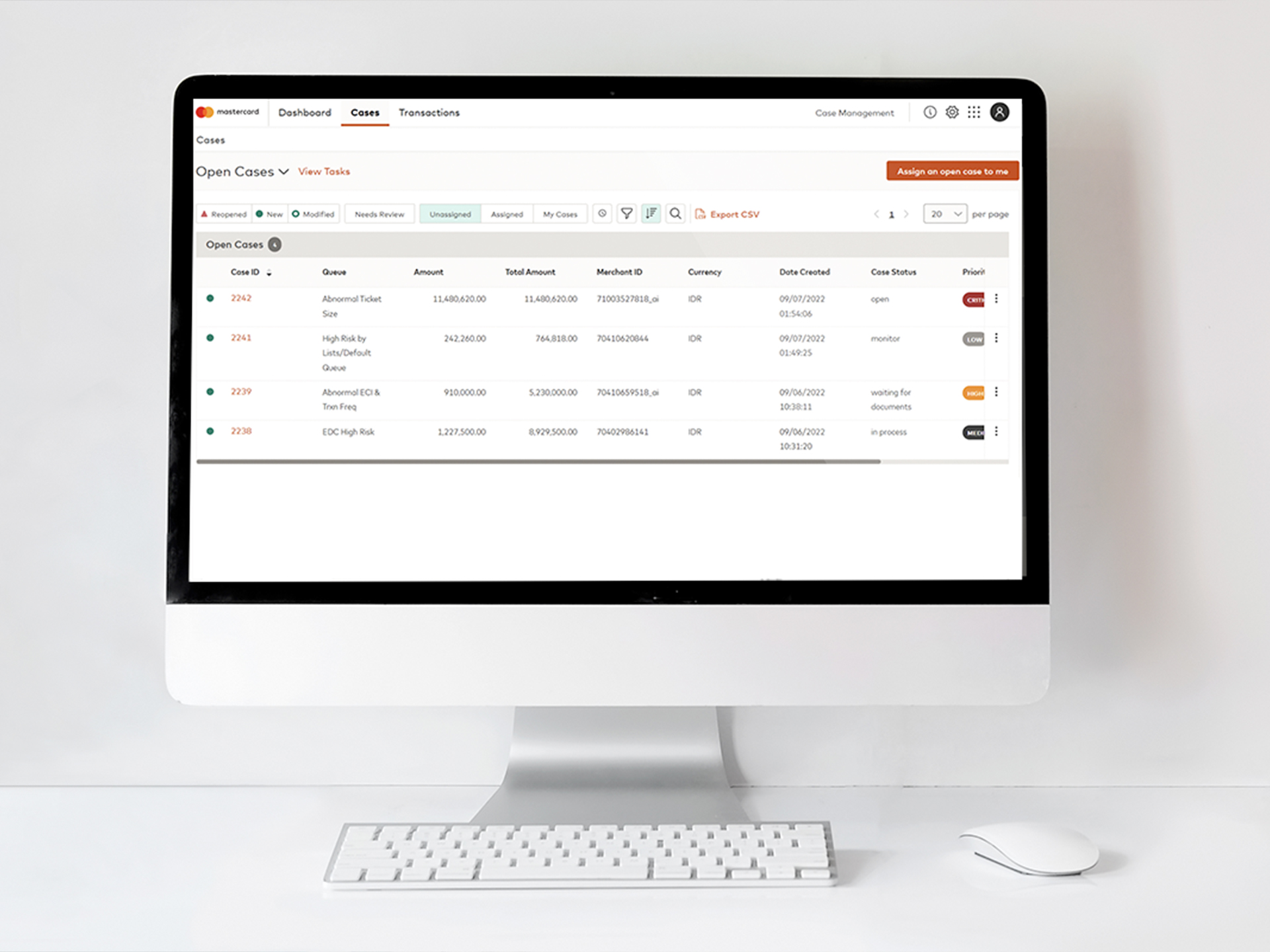

Use the customizable Business Insights module to create reports and the Case Management module to manage investigations and evaluate alerts.

How can you benefit from A2A transaction fraud monitoring?

Frequently asked questions

How does A2A Transaction Fraud Monitoring work?

Brighterion applies behavioral profiling to the monetary transfer history of both senders and receivers associated with an account, creating intelligence on users’ usual transaction patterns to provide real-time fraud prevention. Output scores indicate the likelihood of fraud and scams in real time.

What kind of transactions does the A2A solution cover?

A2A Transaction Fraud Monitoring is a powerful AI solution that detects fraud across payment rails. This highly accurate solution protects you and your customers from attacks such as authorized push payments fraud, account takeover (ATO) and other scams.

How do I receive risk scores?

The scores are received through the Brighterion AI intuitive interface that comprises Rules Management, Case Management and Business Insights modules. Using the interface, you can adjust your risk thresholds to balance risk with profitability.

What does Mastercard need to get me started?

The solution is built quickly using your historical data and is ready to deploy in just weeks. Together, we will determine your business goals and work with you to collect and clean your data. We then prepare your data and select the appropriate modeling techniques for your desired outcomes. When the model shows the desired results, we will present it for your evaluation and review deployment options and plans.

Can I deploy A2A transaction fraud monitoring globally?

Yes, you can deploy in any market worldwide and start seeing results right away.

What kind of results can I expect?

Maximizing our knowledge of fraud from decades of experience, Brighterion’s AI has shown a 50 percent incremental increase in fraud/scam detection with 99.75 percent approved transactions for one of the world’s major A2A payment networks.

Interested?

Experience the power of Mastercard AI