Creating efficiencies empowering SIUs

Mastercard AI detects anomalous healthcare claims before they’re paid. It provides accurate risk scores to healthcare payers so SIUs can focus on high-risk fraud.

HEALTHCARE FWA EXPERIENCE

Mastercard has decades of experience extracting intelligence from payments data for healthcare and commercial transactions. Trained on this intelligence, our models are effective at accurately identifying the wide variety of FWA challenges.

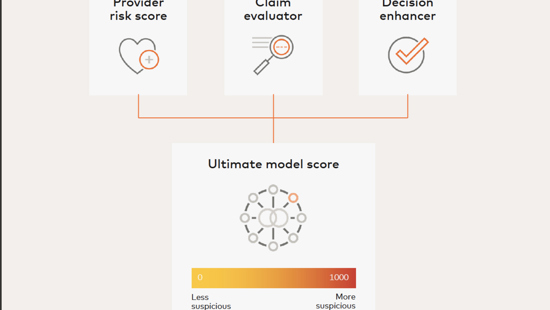

How does Healthcare FWA work?

Mastercard uses AI Express to build your custom AI solution.

Once deployed, the model delivers risk scores via the intuitive user interface. Scores are based on the model’s robust view of each provider.

Use the customizable Rules Management, Case Management and Business Insights modules to optimize your workflow.

How will you benefit from our healthcare FWA solution?

Frequently asked questions

How does Mastercard for FWA work?

Mastercard AI helps payers detect erroneous or fraudulent claims — before reimbursing providers. Artificial intelligence (AI) models can be tailored to identify healthcare claims fraud, prescription abuse, upcharges, phantom billings, and many other FWA challenges.

Why is Mastercard working in the healthcare sector?

Mastercard® Healthcare Solutions is building on its long-held success in healthcare with payment cards and solutions to address FWA. We are using the same advanced fraud prevention technologies that we use for the financial services industry. We see an opportunity to save healthcare organizations millions of dollars.

How does Mastercard for FWA detect fraud before claims are paid?

Fraud detection begins the moment a claim is received for analysis. Processing more than 1 billion transactions per day, Mastercard AI analyzes thousands of data points and hundreds of decision points daily. This volume makes our AI models proficient at recognizing fraudulent patterns and flagging suspicious activities that require investigation. Using real-time analysis, the AI produces a risk score that may indicate fraud, waste and abuse. Analysts can elevate the claim for investigation or approve it if the risk is minimal.

How does Mastercard work with us and what’s the process?

Using AI Express, Mastercard’s proven six-step process, we will quickly build a complex custom AI solution using Brighterion AI technology and prepare you for model deployment in a matter of weeks.

Our team will meet with yours to discuss your business challenge. The Mastercard team comprises data scientists skilled at designing custom AI models, domain experts experienced in using AI in healthcare and developers who build models geared to solving your business’s challenge. One of our skilled project managers will keep the team on track and liaise with your team lead.

Together, we will determine your business goals and work with you to collect your data. We then prepare your data and select the appropriate modeling techniques for your desired outcomes. When the model shows the desired results, we will present it for your evaluation and review deployment options and plans.

How will the custom model be built?

Your personalized model will be built using your historical data. This and future data are received from any source, in any format, and Brighterion AI enriches it using both artificial intelligence and machine learning. We will build three iterations and present the most effective version to your team. With your approval, we will finalize the model and ready it for deployment.

Our full-stack, state-of-the-art modeling allows us to create custom models in a matter of weeks using our proprietary suite of data science, machine learning and ensemble technologies.

The proprietary machine learning includes features engineering, model generation and ensemble tools to build an optimal model across segments.

How should I prepare my data?

AI Express works with any format from most data sources. We will help you collect, describe, explore and validate data. We take it from there, using our proprietary technology to select, clean, construct and integrate data into our model-building process.

How do I receive risk scores?

The scores are received through the Brighterion AI intuitive interface that comprises Rules Management, Case Management and Business Insights modules. Using the interface, you adjust your risk thresholds where you balance risk with profitability.

Interested?

Experience the power of Mastercard AI