Demystifying payment authentication across Latin America and North America

Let’s set the scene: Anne Davis, a busy finance rep, is eyeing a sale on running shoes for her next half marathon and decides to purchase them. A loyal customer, she fills in her usual payment details, including her shipping address, email, phone number and credit card information. She eagerly clicks “Buy Now.”

However, instead of a confirmation, Anne is greeted with an unexpected message. Despite being a genuine customer and having enough credit line on her credit card, her transaction has been declined.

Anne’s experience is not unique. Across the Americas, authentication measures are significantly hindering the consumer experience. In Latin America, a staggering 20% of all e-commerce transactions are declined as fraudulent—twice the global average. (1) Furthermore, consumers in the continental United States face the highest decline rates in the world at 56%.(2) Analysis by Stripe reveals that as businesses intensify their fraud prevention efforts, they inadvertently increase the likelihood of blocking legitimate charges. These false declines have a profound impact; in fact, 33% of consumers report that they would refrain from shopping at a business again after encountering a false decline. (3)

While delivering an exceptional consumer experience and completing sales remain top priorities for merchants and issuers worldwide, the surging card-not-present fraud rates present a significant challenge. North America bears the brunt, accounting for over 42% of global e-commerce fraud by value in 2023. (4) Meanwhile, Latin America has experienced impressive e-commerce growth in recent years but is also facing a significant surge in fraud, with an estimated 20% of all e-commerce revenue lost to fraudulent activities—second only to Southeast Asia in this regard. (5)

Imagine a scenario where improved data collaboration between merchants and issuers serves as the cornerstone for balancing an exceptional consumer experience with robust fraud prevention.

In North America and Latin America, the lack of regulation in payment authentication, combined with the fragmented nature of merchant and financial institution systems, has led to a widespread misconception. Many believe that these factors inherently introduce unnecessary friction and result in transaction drop-offs.

This prevailing notion misses two important factors:

Data collaboration:

In Anne’s example, the merchant did not share the relevant data to the issuer that indicates Anne is low-risk and, due to the lack of data, the issuer declined a genuine transaction, leading to a lost sale for the merchant.

Strategic use of friction:

While genuine, low-risk consumers like Anne should be enabled to transact without friction, the real value of friction comes into play when higher-risk transactions are challenged, helping reduce fraud rates.

This blog aims to demystify payment authentication and showcase the benefits of risk-based assessments for smoother, more customer-friendly checkout experiences for genuine transactions.

What is payment authentication?

Payment authentication verifies the customer’s identity during a transaction. One globally recognized authentication protocol is EMV®3-D Secure. EMV®3DS as a protocol is set up to enable richer data sharing between merchants and issuers for better decisioning and customer experience. The data provided by merchants to issuers can help achieve a seamless transaction experience while still mitigating fraud attempts.

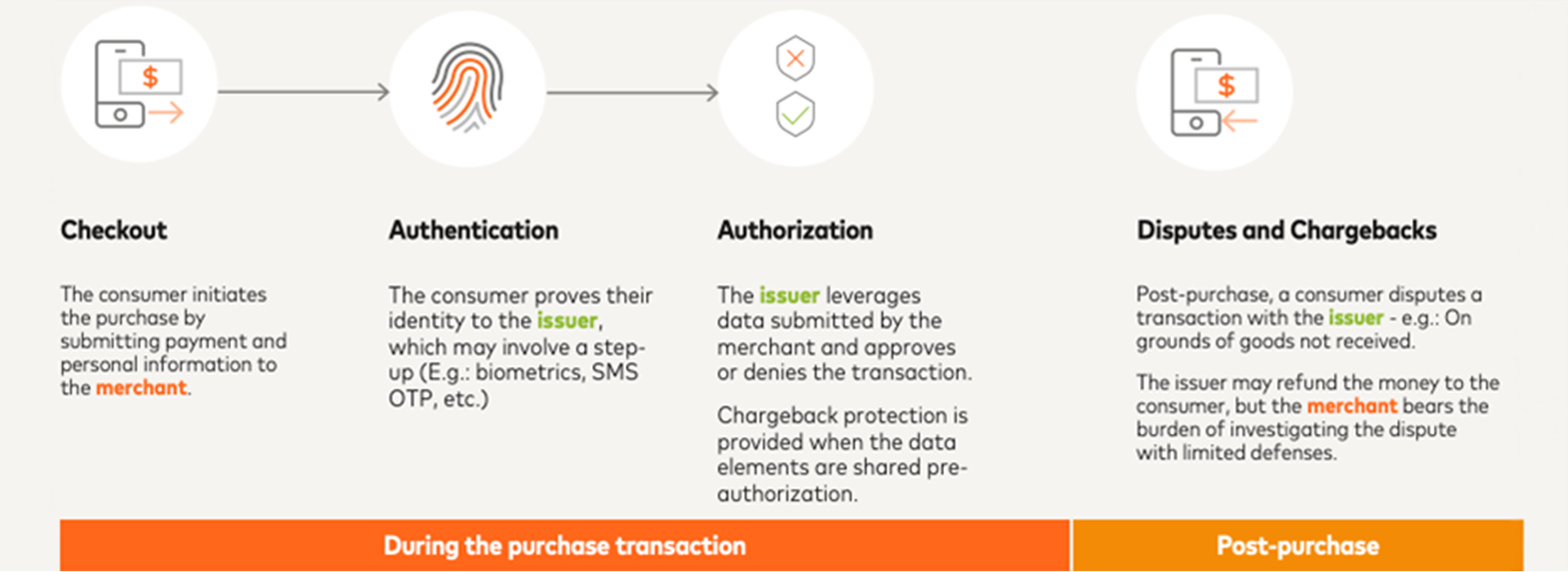

The difference between authentication and authorization

It’s important to distinguish between payment authentication and authorization, as they are different stages of the payment process. While authentication focuses on confirming the identity of the person making the purchase, authorization verifies that the consumer’s payment method is valid and has sufficient funds to complete the transaction. Remember, authentication precedes authorization for digital transactions.

What are the benefits of risk-based authentication?

The primary objective of EMV®3DS is to enhance the authentication experience through risk-based decisioning, commonly known as Risk-Based Authentication (RBA). With the rise of online transactions and fraud activities, RBA has become an essential tool for improved authentication. Acting as a dynamic, intelligence-based security layer, RBA protects digital transactions in real-time by leveraging the data provided in the EMV®3DS message construct. This enables better visibility into the riskiness of an identity, allowing issuers to make informed decisions.

When properly implemented, RBA allows issuers to seamlessly approve transactions for genuine consumers while applying intelligent friction to higher-risk transactions. This dynamic approach prevents fraud without deterring legitimate customers, ensuring a smooth transaction process. Efficient risk assessment solutions are leveraged at various transaction touchpoints to determine if a transaction is low-risk before authorization.

This enhanced visibility into identity enables issuers to analyze every authentication request in real time and choose the best path for the cardholder. As a result, abandonment rates are reduced and frictionless transactions increase. In fact, more than 58% of transactions in North America are authenticated seamlessly and without friction, proving that authentication does not always necessitate a challenge to the flow. Meanwhile, higher-risk transactions are appropriately challenged, which helps to reduce fraud rates by up to 29% in North America. (6)

Ultimately, issuers, merchants, and cardholders alike benefit from a superior consumer experience, with decreased drop-off rates, fewer false declines, and reduced fraud incidents. This holds true even in regions like the U.S. and Canada, where authentication is not regulated.

The benefits of authentication for merchants and issuers

For consumers like Anne, payment authentication ensures a faster and more convenient purchasing experience with built-in trust and security, reducing the risk of misuse, fraud and outright abandonment.

For merchants and issuers, the benefits are substantial:

1. Increased approval rates

Securely sharing transaction-specific data between merchants and issuers improves transaction insights, leading to higher approval rates and fewer false declines during authorization.

2. Reduced chargebacks

Using biometrics or other robust authentication methods decreases the likelihood of fraud and, ultimately, chargeback claims, as authenticated transactions provide strong evidence against unauthorized purchase disputes.

3. Prevention of first-party fraud

Data sharing between e-commerce platforms and issuers plays a crucial role in identifying behavioral patterns that align with a legitimate customer's activity, reducing the likelihood of first-party fraud. By leveraging enhanced fraud prevention initiatives like the First-party Trust Program*, which integrates existing authentication protocols, merchants can present compelling evidence directly to issuers during disputes. This approach not only saves issuers time and resources but also safeguards merchants' revenue and inventory from fraudulent claims.

4. Enhanced authorization insights

Authentication provides valuable risk-assessment insights that help issuers make accurate authorization decisions, preventing fraud and increasing conversion rates.

5. Encouraged cardholder loyalty

Robust fraud prevention, convenient transaction methods like biometric payments, personalized rewards and compliance with security standards build trust and enhance brand perception, fostering long-term cardholder loyalty.

6. Increased sales velocity

It's simple math: a faster, more seamless checkout flow can lead to more impulse buys and higher average order values.

Working with Mastercard

Mastercard’s Identity Check program (IDC) uses the latest EMV®3-D Secure standards and proprietary technologies to deliver enhanced authentication security and an improved digital experience.

Our IDC program offers real-time risk-based insights on transactions through Mastercard's risk-based authentication platform. By implementing EMV®3DS with the IDC program, issuers can analyze transactions using multi-layered data and leverage Mastercard's proprietary services to optimize payment flow based on these insights.

This approach aims to increases approval rates for genuine transactions without adding friction, while helping to prevent fraud and maintain security and simplicity, even when step-up authentication is required. The result is a seamless and secure experience for issuers, merchants and cardholders alike.

How to leverage Mastercard’s IDC program:

Identity Check Standard and Insights

Merchants can enhance approval rates and mitigate fraud by utilizing full authentication methods with intelligent friction for higher-risk transactions. For loyal or low-risk customers, such as Annie, Mastercard’s data-only flow offers a frictionless experience by sharing transaction data with issuers, thus minimizing the likelihood of false declines while expediting the transaction process.

Conversely, for higher-risk transactions, a comprehensive authentication approach is advisable. Mastercard’s insights provide issuers with the necessary information to make informed decisions regarding the authentication process. This may involve continuing with a frictionless experience or implementing additional steps such as app notifications, SMS OTP, or biometric verification. According to Mastercard's Identity Check Authentication data, in the past year we've seen biometric authentication proving to be effective, with an 87.5% success rate globally and a significant reduction in fraud compared to other methods(6).

In conclusion

In regions such as North and Latin America, merchants and financial institutions encounter significant friction due to current authentication practices. Many payment systems are not optimized for the multi-layered checks and seamless experience that EMV®3DS can provide, resulting in higher cart abandonment rates, increased false declines, and elevated fraud rates.

Even in countries without regulatory frameworks for authentication, merchants, issuers and consumers can realize substantial benefits by adopting optimized authentication for online transactions. By understanding and leveraging payment authentication, issuers and merchants can foster a secure and efficient payment environment that benefits all stakeholders. The key lies in intelligently balancing friction—enhancing the customer experience while effectively combating fraud.

SOURCES:

- Digital payments bloom in Latin America – but fraud flourishes, Payments Industry Intelligence, 2022

- Trust Premium Report, 2023, Winning the Next Generation of Online Consumers, Forter, 2023

- The state of online fraud, Stripe, 2022

- Online Payment Fraud, Emerging Threats and Segment Analysis 2023-2028, Juniper, 2023

- E-commerce fraud trends and statistics merchants need to know in 2024, Mastercard, 2024

- Mastercard Authentication data, 2023 – 2024

- *Currently available only in North America. For additional information for your region please reach out to your Mastercard account manager