How telco providers stay ahead of third-party risk

More innovation, more complexity

The telecommunications industry is evolving and growing at an exponential rate, with revenues projected to rise 6.2% annually through 20301. This surge comes from a multitude of new offerings — new entertainment and data services, financial solutions, gaming and virtual reality, identity and home security, advertising, and other offerings — many of which are brought to market in partnership with other providers and third-party vendors.

The rapid pace of advancement can expose the network to new security risks and vulnerabilities. For example, the growth in 5G is driving IoT connections and new players into the digital ecosystem, contributing to a rise in threats and vulnerabilities. Bad actors require only one weak link in a vendor network to threaten the entire ecosystem.

Cyberattacks on corporate networks rose 50% in 20212, and the communications industry ranked third in attacks overall, making telco one of the sectors most exposed to attacks. The global telco industry lost an estimated $39.9 billion to fraud in 20213. As a leading player in the digital ecosystem, it is vital that telcos are resourced to counter the rising number of threats.

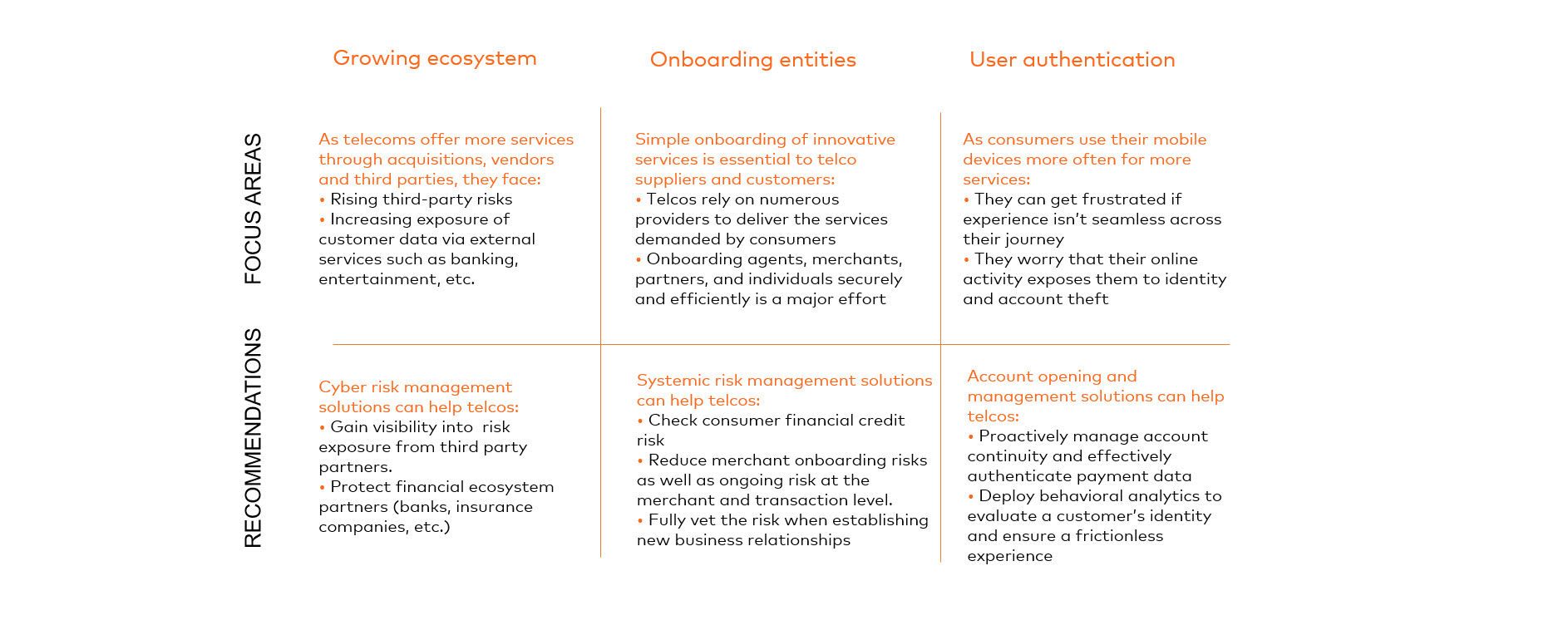

A growing network opens the door to more threats

The average telco has thousands of third-party partners, software vendors and managed service providers in their network — making evaluating each vendor’s cyber vulnerabilities highly complex and resource-intensive. Each vendor and partner follows their own security strategy, which may leave the door open to vulnerabilities that directly impact the telco.

Not only are these risks costly to telcos, they also harm customers who have little patience for risk from their telecommunications providers. In fact, nearly three out of four US consumers (73%) say they will walk away from a brand after only one poor customer service experience4. This risk to brand reputation and customer loyalty, along with fraud, extends to partners and other stakeholders in the value chain, such as financial services and entertainment companies.

How we can help

The telecommunications industry is enjoying continued growth as consumers embrace the always-on convenience of a mobile lifestyle. Yet, with that growth come many new challenges to the industry. Telcos can seize this opportunity to incorporate innovative new services that transform the user experience, deepen customer engagement and loyalty, and ensure confidence in the security of customer data while simultaneously lowering costs and increasing revenue. Choosing the right technology partner to do so is critical. Mastercard, a widely recognized technology innovator, has the proven technology, deep industry experience and commitment to help telcos:

- Optimize their business: Seamlessly implement new services to increase revenue while reducing operating and capital costs

- Enhance customer journeys: Improve the user experience and customer journey at every interaction

- Mitigate fraud: Secure digital identities, resist cyberattacks and authenticate users and devices end-to-end

Mitigate cyber threats within your organization and across your business relationships

Mastercard’s third-party risk management capabilities provide continuous cyber risk monitoring of your third-party and extended supply chain. This approach allows you to preemptively identify, prioritize and reduce risk.

Learn more about how we help telcos here

(1) Grand View Research, Telecom Services Market Size, Share & Trends Analysis Report By Service Type, By Transmission, By End-use, By Region, And Segment Forecasts, 2023–2030.

(2) S. Securities and Exchange Commission, 'SEC proposes to enhance disclosures by certain investment advisers and investment companies about ESG investment practices', 25 May 2022.

(3) Library of Congress, 'Germany: New law obligates companies to establish due diligence procedures in global supply chains to safeguard human rights and the environment', 17 August 2021.

(4) World Economic Forum, 'Stakeholder Metrics Initiative: Over 120 companies implement the ESG reporting metrics'