The frictionless future of real-time payments

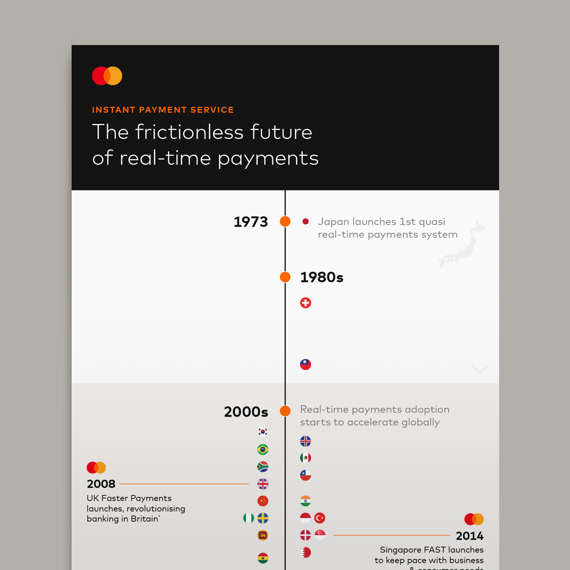

October 1, 2019 | By Hayden HarrisonOver the last decade, the implementation of national real-time payments systems has accelerated. Over 70 countries either already have or are in the process of transitioning to instant payments, accounting for 87% of the world’s GDP and two thirds of the world’s population.

Real-time payments have become the norm — and a commodity. This means speed is no longer a differentiator. Rather, what payment system operators and banks do with that speed is what will set them apart from their competitors.

The value of data

Leveraging richer data opportunities afforded by ISO 20022 message standards, and advanced message formats such as ‘request to pay’ and ‘request for information’ can create new and innovative use cases, drive differentiation, reduce friction and unlock the true value of instant payments.

Payment rails built using ISO 20022 messaging also enable participants to improve cost and time efficiencies, and can lead to interoperability between players both within domestic payment systems and internationally. Over 33 real-time payments infrastructures across the globe have already migrated to ISO 20022 standards.

Deployed as a managed services model, our Instant Payment Service provides a real-time clearing and settlement for batch-input and individual payments with rich ISO 20022 message functionality with 24/7 availability. It includes overlay services, such as directories that enable more seamless transactions between people, businesses and banks across all payment flows.

Enabling the frictionless future of real-time payments

Mastercard, leveraging capabilities of Vocalink, a Mastercard company, currently operates four live real-time payments systems in the UK, Singapore, Thailand and the US. We’re currently rolling out regional managed services to serve the Latin America and Caribbean region from our base in Peru, and in Asia-Pacific from our base in the Philippines which will enable new countries that join to benefit from cost efficiencies through shared infrastructure.

In 2019 we were chosen to introduce real-time payments to Saudi Arabia and selected by the P27 Group to deliver the world’s first multi-currency shared payments platform for the Nordic region. Our national infrastructure solutions will soon be live in countries that account for 32% of global GDP, with a total population of 671m people and a potential reach of 428m account holders.