Frictionless money movement: Powering inclusive growth across Asia Pacific

Around half the world’s annual remittance flows - worth more than U.S.$700 billion – now pass through the Asia Pacific region. This huge sum has been fueled in part by a rise in people moving countries to seek work and explore new opportunities, and in return sending money back home to financially support their friends and family members.

Automotive worker Nguyễn Đức Thành is one of these workers. While living in Japan, every two months, he would send 50 million Vietnamese dong (around U.S.$2,000) back to his family in Vinh Phuc, Vietnam.

“I chose to move to Japan to secure a steady income for my family and to gain life experience,” says Mr. Thành, “I regularly sent money home to my parents to cover their everyday living expenses but also to provide a contingency fund for emergencies. Supporting my family is essential for me; the money I made and sent back was very important for their wellbeing.”

Mr. Nguyen Duc Thành, on the far left, with his extended family in Vietnam

In the region, Mr. Thành is one of many who have or are currently working abroad in order to support family. Research from Mastercard’s latest borderless payments report found that nearly half (49%) of consumers surveyed in Asia Pacific have sent money internationally because they have been concerned about their families abroad and want to support them.

With billions of dollars’ worth of international remittances flowing through the region, there is a pressing need for new technologies and modern payments infrastructure that can not only bear the load, but also provide frictionless money movement experiences.

Creating seamless payment flows

“Money movement takes many forms,” says Sandeep Malhotra, executive vice president, Products & Innovation for Asia Pacific at Mastercard. “But the common theme among senders and recipients alike is the desire for frictionless, fast payments.”

Meeting this demand for faster, more transparent and accessible cross-border payments is not only crucial to meeting customers’ needs, but also furthering inclusive economic growth in Asia Pacific more widely.

Providing frictionless, fast payments can help ensure families back home can receive the money they need, whether to pay tuition fees, medical bills, or to simply cover everyday expenses, as in Mr. Thành’s case.

While important to those living abroad and making international money transfers, this is equally important for small businesses in Asia Pacific too, with 86% of SMEs with 86% of SMEs surveyed by Mastercard in the region saying they are planning to do more international business in the future. As a dominant global manufacturing hub – China exported goods valued at U.S.$3.73 trillion in 2022 – businesses in the region also need frictionless money transfers to operate and pay local and international suppliers and workers on time.

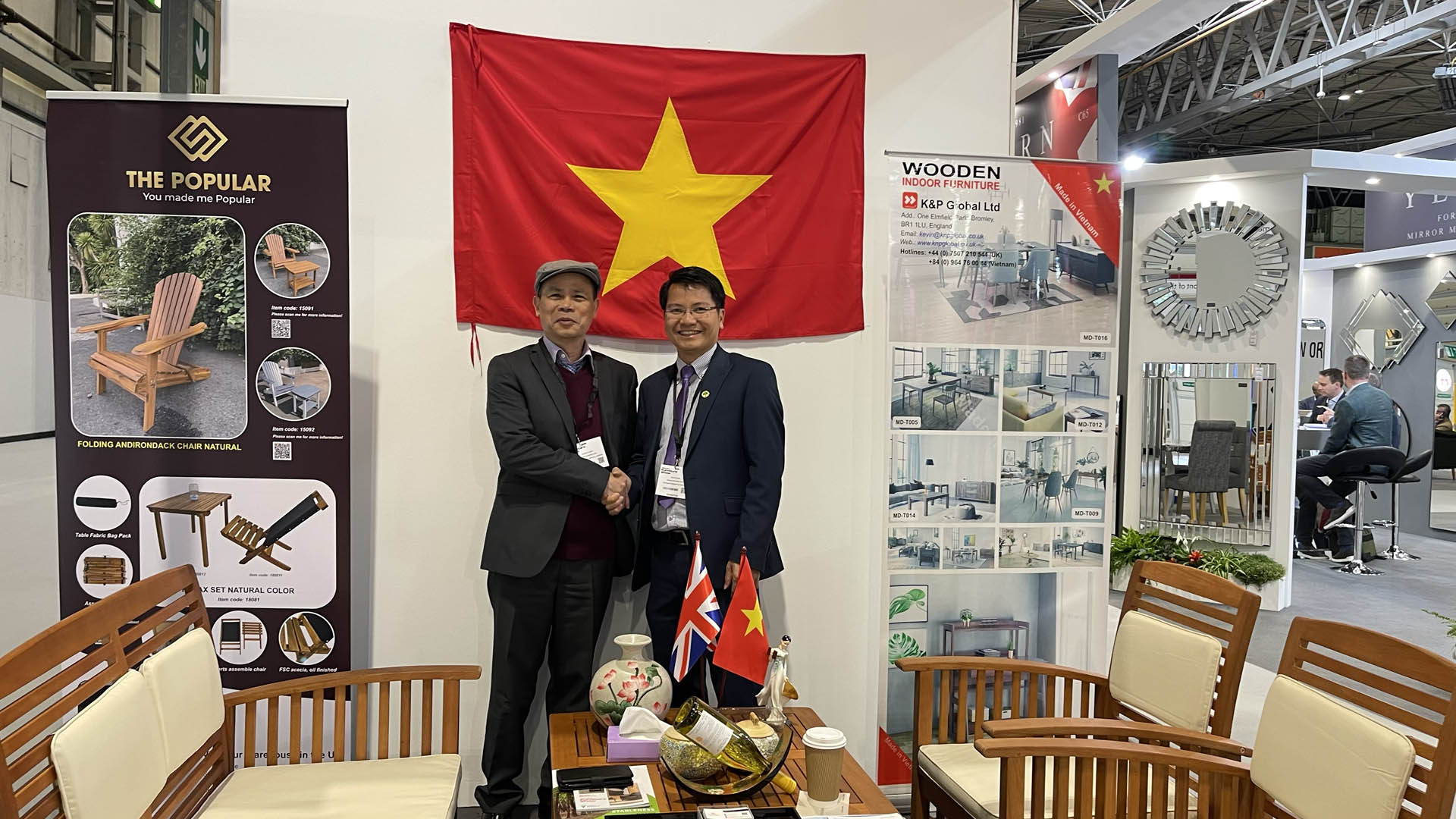

Kevin Pham is a UK-based Vietnamese national who runs a business to help Vietnamese manufacturers access UK and European markets. As part of this, he regularly makes and receives payments to countries including Singapore and Korea. Mr. Pham described the cross-border payments system as the “backbone of our business operations.”

“For us, secure transactions are paramount for fostering strong relationships with international clients and suppliers. Any hiccup in payments could cause disruptions in our supply chain, strain partnerships, and compromise our reputation for reliability,” he added.

Mr. Kevin Pham, on the right, with a Vietnamese government trade representative at a furniture trade show in the U.K.

Despite the importance of these payments for so many individuals and businesses, Mastercard’s borderless payments report also highlighted how many are seeing their cross-border payments experience fall short.

It reveals that many people and businesses still face delays, a lack of transparency and limited choices when it comes to making and receiving payments. According to the research, 31% of people making cross-border payments in the Asia Pacific region have no way to track the status of a transfer or when it will arrive and 23% say there are few or no options to deliver funds in their recipient’s preferred way. These issues are stifling progress when it comes to inclusive growth in Asia Pacific, with people unable to access money when they need it, and even avoiding making payments in the first place.

In fact, the research finds that 84% of consumers and businesses making cross-border payments in the Asia Pacific region say they would send money more often if it were faster to do so.

Addressing pain points

Mastercard is working with banks, fintech companies and governments to address those issues and provide consumers and businesses alike with “frictionless” payments. These are characterized by Malhotra as being made at high speed, with low costs and robust security. A process whereby financial data is analyzed and validated quickly, and where people and businesses can get paid digitally and in near real-time.

The digitalization of financial services is gathering pace rapidly in the Asia Pacific region, with Mastercard data showing that seven in ten (68%) people making cross-border payments are doing so via an app on their smartphone, with 36% specifically using a digital wallet. In response to this trend, banks across the region are working to enhance their digital channels such as m-banking apps and are offering additional services such as remittances. Enhancing digital channels to offer remittance services is a win-win situation as it helps banks monetize these channels while building stronger relationships with their consumers.

While the rise in digital channels is clear, cash still makes up 16% of payments in the region, and so with a range of payment methods still in use, people and businesses must have choice over how they send and receive money.

“Asia Pacific has a high diversity of both sender and receiver markets,” adds Malhotra. “Sender markets tend to be more developed, while receiver markets are usually developing. We therefore need a diverse range of solutions to meet the requirements of different customers.”

For Malhotra, industry players – from leading fintechs to incumbent financial institutions – need to work together to deliver choice and ensure safer, simpler, and more seamless cross-border payments.

Fostering greater inclusion

Mastercard Move helps banks and fintechs offer more ways to reach countries with a more limited financial infrastructure. Subject to specific market availability, this includes card, account-to-account, mobile wallet and cash payout locations, ultimately reaching more people. By combining the relationships with banks and other money services providers it has cultivated over decades with the latest in digitization and cybersecurity, Mastercard Move’s reach now spans more than 180 countries and more than 150 currencies. It has access to more than 95% of the world’s banked population and cash-pickup reach to billions more who are unbanked.

Ensuring quick, convenient payments rooted in choice – whether it is within one country or across borders – will help lift the Asia Pacific region’s economy as a whole by enabling more small businesses to expand into international markets, supporting jobs and economic growth.

Alongside this, it will also help deliver inclusive growth for the region by allowing more people and businesses to send and receive money how and when they choose, with greater certainty. This is particularly important for less wealthy families who are the main recipients of remittance payments and stand to benefit the most financially from the ease and speed that modern payments can unlock.

This is what Mastercard aims to achieve with its Mastercard Move portfolio.

Mr. Thành’s situation showcases just how important innovations in this space are for families across the Asia Pacific region. “My becoming financially independent has coincided with my parents' retirement, which means they are now without a steady income. Families like mine, where parents lack a pension and have exhausted their income on their children's education, particularly with younger children still in school, could face major challenges in their later years. Having an individual with a stable income to offer support to the rest of the family is crucial.”