Introducing: payments modernization series

January 12, 2022

The concept of payment system modernization encompasses the majority of participants in the financial services ecosystem, including central infrastructures, banks, fintechs and ultimately any payments provider offering services directly to governments, corporates, merchants or consumers.

The world’s payments entities must become sharply focused on their end users, and continuously adapt in order to protect and grow revenue streams, streamline costs and unlock new opportunities by delivering improved, innovative propositions.

Introducing a new series of insights

Payment system modernization can be a daunting and complex journey. That’s why we’ve reviewed 81 global markets, including 61 real-time markets, to develop a series of fresh insights that will help payments entities better understand the different elements and guide them through the process.

This new series is all about sharing best practice, providing information and examples to help stakeholders across the financial services value chain map out their own strategy. It’s relevant to anyone seeking to better understand payments modernisation, in addition to the drivers behind the profound industry changes being seen throughout the world.

The opening chapter outlines what we mean by payments modernisation, looking at how different countries have taken different paths, shaped by a diverse range of needs, drivers and influences. Subsequent chapters will examine themes including: how the rise in non-cash transactions is powering the digital economy; the rapid and widespread development of real-time payments systems; how ISO 20022 has become an increasingly prominent feature of payments modernisation discussions; and how exponential gains to computing processing power and communications bandwidth have made it possible to deploy to the cloud securely for increasingly complex and critical payment application workloads. The final chapter will shine a light on the value-added services that are overlaid onto the infrastructure, providing access and innovation (“overlays”).

Mastercard helps countries, banks and businesses to modernise their payments systems. Underpinning our work is Mastercard’s multi-rail strategy, which brings together card, bank account and alternative digital propositions (e.g. cryptocurrencies/Central Bank Digital Currencies) to cater to a broader range of payment types and experiences.

We’ve established ourselves as a trusted partner because we don’t just talk about real-time payments systems and surrounding services, we deliver them every day. Mastercard is powering real-time payments in 15 of the world’s markets, including 13 of the top 50 countries by GDP.

Building your framework

This diverse global experience has taught us that payments modernisation is a unique journey for each market. The perspective of what you’re looking for will be shaped by where you’re looking from, and one country’s outlook and approach may be completely different to another’s.

Historically, there has been no ‘one-size-fits-all’ scenario, but the opportunity to standardise does exist. The reason we see so many differences is that developments have traditionally been domestically-focused, without a global perspective. Mastercard brings this global perspective.

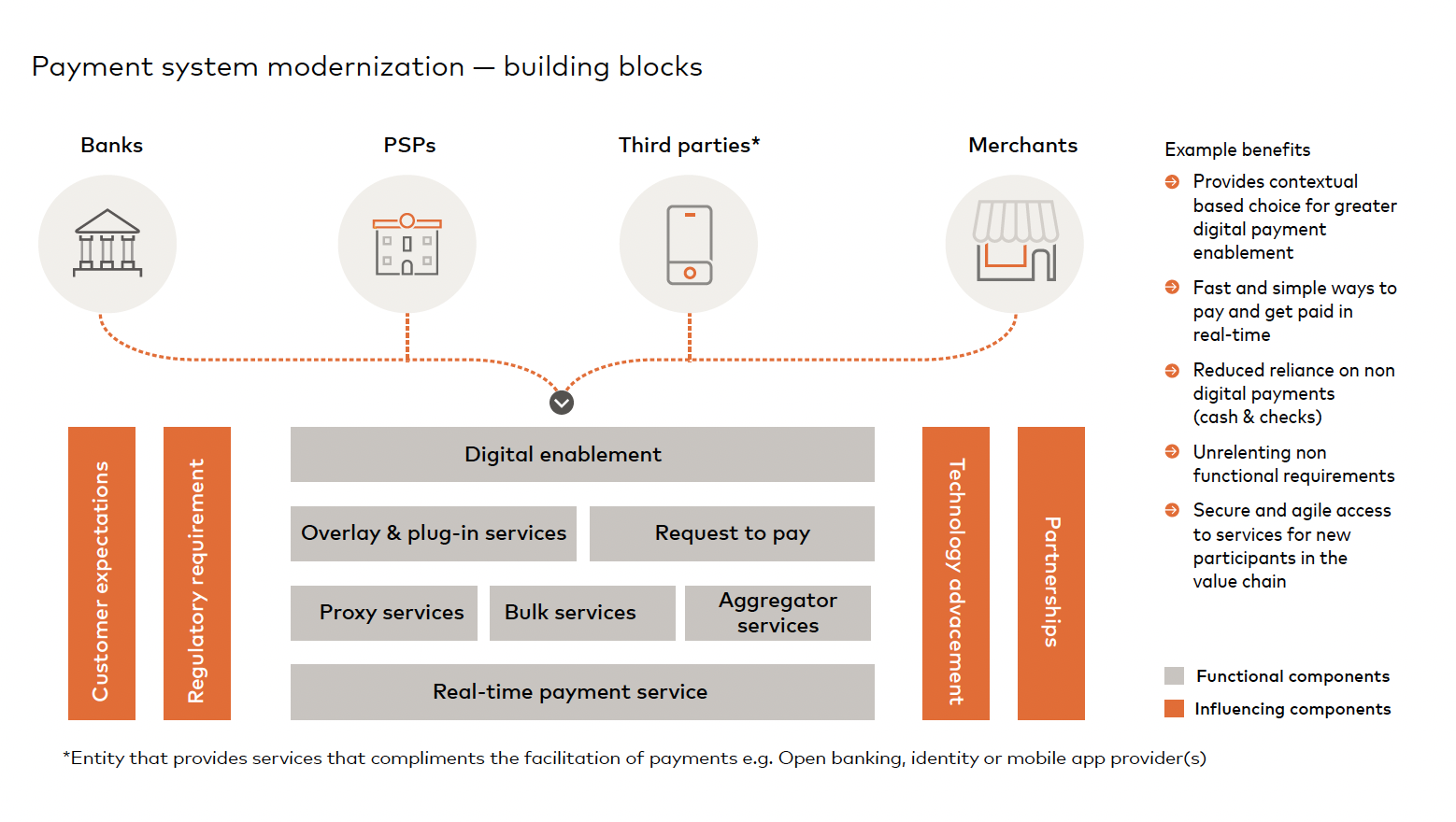

We have identified some key factors that countries and organisations should consider when planning their modernization programmes. Building blocks that can facilitate the implementation journey and offer up a safe, secure and resilient platform that ensures an open, inclusive and innovative environment that allows new value-added services to thrive.

Another measure to achieve greater success is to ensure that the participant layers, i.e. the end-to-end processing environment, is in sync to provide compatibility for the enablement of services such as data and overlays.

The following diagram highlights the building block approach which will be broken down across our payments modernisation series to show the value of each section.

Technology is reshaping the economics of how we all do business. Traditional barriers to change, such as costs and complexity, have been eroded in favour of efficient, open and scalable platforms available to all.

One of the most important advances in recent years is cloud computing. The use of cloud environments is an entirely different approach to managing payments, providing more flexibility, efficiency and scalability while potentially also providing equal levels of resiliency.

While the use of cloud technology to run payments systems may still be the exception rather than the rule, the speed with which technology is progressing makes it an increasingly practical solution. The challenge now is for regulators, banks and other stakeholders to appropriately assess these developments.

Real-time payments continue to be central to payments modernization efforts, with policy-makers recognising them as integral to driving innovation and growth. As of Q2 2021, there were 66 markets globally with live access to real-time payments, accounting for more than 90 percent of global GDP.

Those developing real-time payments systems should carefully consider these five points:

- Ubiquity and reach are crucial. Everyone who can participate must be able to connect easily and securely to the infrastructure from the outset.

- Access takes multiple forms. While some payments systems provide access to non-banks, this will differ as a priority from market to market. Most see the benefit of opening up to enable more market players to participate, therefore facilitating more transactions.

- Cross-border interoperability is important. It’s a challenge that requires cooperation at a multi-market level, but should be a key consideration when looking at the standards, design and technology used in your system.

- Bulk/batch still has a role. While real-time payments are growing fast, traditional bulk/batch payments are a cost-effective solution that will continue to play a significant complementary role.

- There’s an opportunity for better business use cases. Banks can use modern services to improve offerings for business customers. The benefits go beyond speed, and include improved straight-through-processing (STP) and reconciliation.

ISO 20022 can help hold the framework of payments modernisation together. Through improved data structure, extensible messaging and the potential to interoperate between domestic and international payments systems, it addresses several pain points for banks and their end users.

While the long-term benefits are clear, industry migration will be complicated. With multiple requirements and various mandates on banks to adopt ISO 20022, managing this process strategically is vital.

Being able to transact in real time also raises the challenge of fraud. Machine learning and behavioral analytics provide the tools to meet this challenge head on, enabling fraud to be tackled at an individual bank level. But we can also use centralised transaction data to design solutions that do so at a network or market level.

And then there’s the overlays, applications and value-added services that drive and support usage. These are core to realizing the goal of a modernized national payments system.

Two of the most common and widely-adopted overlays are proxy addressing solutions (which link customer account numbers to mobile phone numbers, email addresses or national IDs) and request to pay. As an industry we also need to think more on how we use the technology at our disposal to address other areas, such as digital identity solutions, and consent and mandate management that provide additional plug-in capability.

Payments modernization is an ongoing process, and one that will continue to evolve in line with technology and changing customer demands. Whilst it may be impossible to completely future-proof your approach, the increasing standardization and flexibility of technologies deployed, if done right, should at least ensure the journey is as smooth as possible.

Choosing the right partner is as important as any design decision you face. Mastercard’s global experience and capabilities in delivering payments modernization affords us unparalleled perspectives to transform insights into market-leading, future-proof, multi-rail solutions.